“Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.”

–John Templeton

Today’s bull market will not die on euphoria. That’s not to say that there hasn’t been more than enough optimism to go around among U.S. stock investors for the last many years now. And this optimism may very well continue for the foreseeable future. But the euphoric blow off top that so many investors believe must take place before this bull market finally dies appears unlikely this time around.

Cause Of Death: Usually Not Euphoria

The cause of death for bull markets is an often misunderstood phenomenon. Many investors will cite the famous quote by John Templeton as evidence that today’s bull market has further to run. After all, we have yet to see the blow off top that defines its end.

But here’s the thing. When reflecting back on the past bull markets in the U.S. stock market, it turns out that nearly all came to an end without any discernable signs of euphoria. This includes nearly all of the notable cyclical bull markets that have taken place dating back to the buttonwood tree in the late 1700s. In fact, the only two bull markets that ended in tulip bulb mania style euphoria were the secular bull markets of the roaring twenties in 1929 and the dot.com boom in 2000.

Instead, all bull markets over the past two hundred years simply continued to mature on optimism with little drama or fanfare before quietly expiring and slowly but surely rolling back over into a new bear market.

A Distinct Lack Of Optimism, Much Less Any Signs Of Euphoria

So why is today’s bull market unlikely to die on euphoria? After all, it is the second longest bull market in history, which makes it far from ordinary. Moreover, it shares some of the same extreme valuation characteristics that defined the two extraordinary euphoric bull market endings from 1929 to 2000.

Euphoria is likely to be lacking from today’s bull market end because a vast number of major market participants never even became all that optimistic about it along the way in the first place. Instead, major segments of the investment population have been already leaving in droves for years.

Consider the following. One characteristic that has historically defined bull markets in U.S. stocks is the strong correlation between rising stock prices and the net inflow of funds from retail and institutional investors into the domestic equity market. But according to data from the Investment Company Institute, what has been unique about today’s bull market dating back to its inception in 2009 is that we have seen a steady net outflow of funds from investors into the U.S. stock market. For example, since the start of 2015 – a time where stocks as measured by the S&P 500 Index (SPY) (SPY) have risen by +30% on a dividend adjusted basis – we have seen net outflows from domestic equity mutual funds and ETFs by retail and institutional investors of more than -$ 200 billion. This is the exact opposite of optimism, much less any sign of euphoria.

So what then has been driving U.S. stock prices (DIA) higher for so many years? Easy money from global central banks and rampant corporate share repurchase activity that has more than offset the steady net outflows from retail and institutional investors throughout the post crisis period.

Put more simply, the average investor never really returned to the U.S. stock market during the post financial crisis period with any sort of conviction in the first place. So what is going to cause them to dramatically reverse course and suddenly become euphoric before it finally comes to an end?

They’re Never Coming Back

A notion that some investors cling to in this regard is that the retail and institutional investor will ultimately succumb to the siren call of repeated new all-time highs in U.S. stocks (IVV) and eventually come flooding back in to seize on the seemingly endless abundance of gains that are on offer. Thus, euphoria still awaits.

But here’s the problem with this notion. Unlike the cryptocurrency market (COIN) where widespread evidence of a full blown mania has existed for more than a year now, U.S. stocks remain mostly lacking in this regard. Perhaps this is due to the fact that investor memories are still too fresh from the two catastrophic bear markets that have taken place since the start of the new millennium.

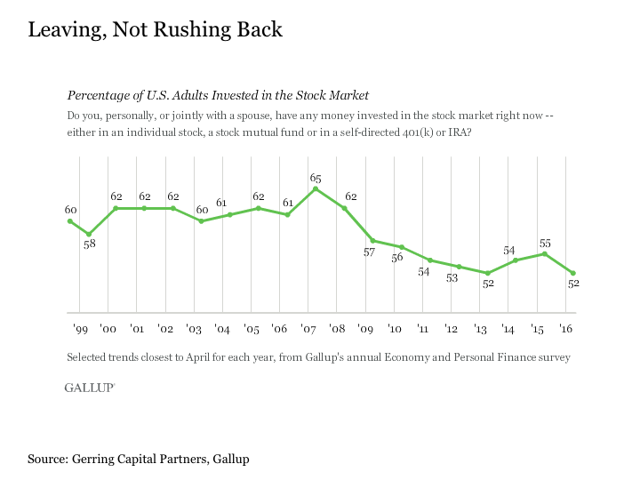

In fact, evidence exists that the exact opposite has been happening. According to a poll conducted by Gallup, the percentage of U.S. adults invested in the stock market has been steadily declining since the outbreak of the financial crisis more than a decade ago. For whereas 65% of Americans were invested in stocks back in 2007, only 52% are so today as of the most recent year of the survey in 2016. Perhaps this measure will have ticked up when the 2017 numbers finally come in, but it remains well below the consistent plus 60% readings from more than a decade ago. Moreover, the trend suggests that a growing percentage of investors are more inclined toward the “out” door than the “in” when it comes to the stock market despite its continued gains year after year since the crisis.

Put simply, if investors have not come flooding back in to U.S. stocks at this point in a market that is already fast tracking its way to becoming the longest bull market in history and instead have been steadily leaving, they are in many ways increasingly unlikely to do so going forward, as many apparently wish not to get potentially badly burned a third time in less than two decades.

Has Optimism Already Peaked?

In fact, while expectations for euphoria are simply off the table, it is reasonable to consider whether mere investor optimism has already peaked in today’s bull market.

How could this be possible? After all, U.S. stocks continue to climb in striking yet another new all-time high to close out the past week.

Consider the following. According to the Stock Market Confidence – U.S. One Year Index from the International Center for Finance at Yale University, stock market optimism may have already peaked in early 2017 and has since been rolling over. For example, the percentage of institutional investors that expected the stock market to be trading higher one year later peaked at over 99% in April 2017. In the months since, this reading has steadily fallen back to 77% as of September 2017. While still relatively high, this represents a 22 percentage point drop in roughly half a year. The same shift is true among everyday people, as the percentage of retail investors that believed the stock market would be trading higher also peaked at over 93% back in March 2017. Since that time, this reading has steadily declined to 68%, which is a 25 percentage point reversal in six months time. Still optimistic to be certain, but decidedly less so versus earlier in the year.

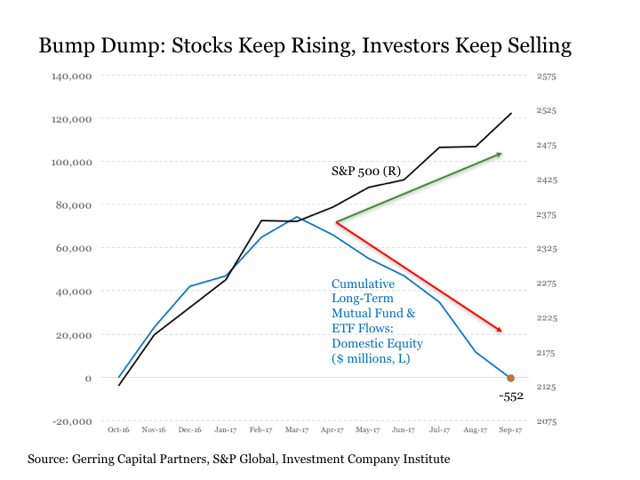

This decline in optimism is also evident in the fund flow data. One of the characteristics that defined the stock market rally that was ignited at the end of 2016 was the supposed rotation out of bonds and into stocks. Ignoring the fact that money flows barely turned negative out of bonds by the tune of just -$ 17 billion at the very end of 2016 and are now cumulatively net positive into bond mutual funds and ETFs by more than +$ 280 billion since November 2016 to date, what was notable that money flows that had been definitively negative out of U.S. stocks for so many years to that point had suddenly turned positive. From November 2016 to March 2017, investors poured +$ 74 billion into domestic equity mutual funds and ETFs according to the Investment Company Institute. Put simply, stock investors were finally coming back after steadily walking away for so many years during the financial crisis period. The stock market leadership baton was ready to be handed off from corporations to the institutional and retail investor, so the thinking went.

But alas, this exchange in leadership has turned out not to be. For along with the erosion in investor optimism about future stock market prospects, we have also seen a definitive departure of the money that was once flowing into stocks. Since peaking in March 2017, net flows have reversed back out of domestic equity funds. In fact, as of the end of September, cumulative net flows related to domestic equity funds dating back to November 2016 have now turned negative by -$ 552 million. In other words, the +$ 74 billion from institutional and retail investors that flowed into U.S. stocks from November 2016 to March 2017 has already now completely flowed back out and then some through the present.

These are not signs of euphoria. They are not even indications of growing optimism. Instead, they are signs that optimism may have already peaked and that creeping pessimism may now be starting to take hold.

This does not necessarily mean that the end of the bull market is imminent. Not at all, for we saw similar readings in peak optimism in May 2006, and the bull market at that time continued to run for more than a year afterwards. But like all bull markets throughout history, it eventually came to an end.

The Bottom Line

So what? Everything is awesome and the stock market continues to strike new all-time highs on a daily basis. So why should I care whether today’s bull market dies on euphoria or not?

Because many investors believe that they have nothing to fear about today’s bull market until they have seen that final euphoric acceleration to the upside. In the meantime, they can comfortably remain long stocks thinking that the end is nowhere near and will know to exit once things get really crazy. But today’s bull market has never been defined by institutional or retail investor optimism, much less any signs of euphoria. Thus, instead of expiring amid a distinct and rampant bout of exuberance, today’s bull market is likely to quietly slip away one trading day like so many past bull markets and start slowly drifting its way to the downside in eventually accelerating with increasing pace into the next bear market. And even more so than the last two episodes, the next bear market is setting up to be a doozy in both in eventual magnitude and torturous duration once it finally takes hold.

Moreover, if recent readings are any indication, the peak in optimism among institutional and retail investors may have already come to pass several months ago now. And as monetary policy from global central banks continues to tighten and corporate share buyback activity continues to wane with the rising cost of debt capital and companies now sporting their highest debt to total capital ratios in modern history, it is reasonable to wonder who will be the marginal buyer of stocks when central banks and corporations finally abdicate from their market supporting role. This is a troubling thought to consider with stocks already trading near their highest valuations in history and rising with each new trading day.

So while the end of today’s bull market is certainly not nigh, it may be drawing closer than some investors may be willing to think. And when it ends, it is unlikely to do so with any manic bout of euphoria. Instead, it is more likely to slip quietly away without notice one seemingly uneventful trading day in the future.

Thus, be ready with your portfolio risk control measures already in place, as no bell is likely to ring to signal the eventual silent passing of today’s ongoing bull market at some point down the road. Still own stocks in a meaningful way, but do so with an eye toward being defensive. And diversify across asset classes as always for added protection in mitigating downside risk.

Disclosure: This article is for information purposes only. There are risks involved with investing including loss of principal. Gerring Capital Partners makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made. There is no guarantee that the goals of the strategies discussed by Gerring Capital Partners will be met.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long selected individual stocks as part of a broadly diversified asset allocation strategy.

Tech