Back in the “pre-cable” days, there was the simple “Boob Tube,” with its three major networks and two to three syndicated networks. The TV industry has grown much more complex in the past few decades, with networks owning cable and web content, video on demand, and Silicon Valley tech firms competing with original content.

Traditional broadcast firms have had to up their game, through consolidation, acquiring non-traditional assets, and now, through increased use of data, in order to “follow the money,” i.e. the customer. “What is he/she watching, and how?” Most importantly, how can we utilize customer data to monetize growing assets, such as video on demand?”

In listening to the recent earnings call from Corus Entertainment (OTCPK:CJREF), it became very clear that this type of thinking is where the industry is headed.

Corus’s CEO, Doug Murphy, said on the earnings call that,

“We’ve made a number of investments which are enabling us to move past the paradigm of selling ads for the adult 25-54 segment, which is a very blunt, untargeted instrument, to specific audience segments against specific shows. We’re transforming the inventory management side of the business, and we’re also transforming how we follow the viewer, and that’s a multi-year project.” (Source: Corus fiscal Q4 earnings call)

As we’ve noted in previous articles about them, Corus already transformed itself over the past four quarters via a mega deal, in which it acquired Shaw Communications’ (SJR) portfolio of TV brands in a transformative $ 2.6B deal. The company divested its pay-TV assets as part of the deal.

Profile:

Corus has now a major presence in the Canadian broadcasting industry – it now owns 45 specialty television channels and 15 conventional television stations, with premium brands, including Global Television, W Network, OWN: Oprah Winfrey Network Canada, HGTV Canada, Food Network Canada, History, Showcase, National Geographic, Disney Channel Canada, YTV, and Nickelodeon Canada.

Corus also owns 39 radio stations that represent the most listened to stations in the Canada, located in eight out of the 10 top markets. The company’s portfolio includes a network of leading news-talk radio stations, as well as classic rock, country, new rock, and contemporary music formats.

Corus also creates original content that is sold in more than 160 countries across the world.

It’s a dominant force in Canadian broadcasting – its specialty TV programming attracts more women in large households (ages 25-54) than any other media company in Canada. It has seven of the top 10 specialty channels among women and kids:

(All dollar amounts in this article are in Canadian currency, unless otherwise noted.)

How and Where To Buy:

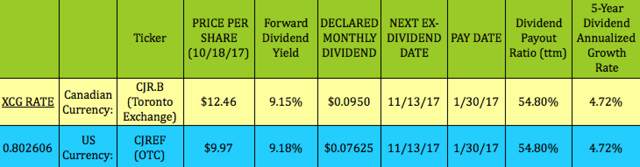

There are two ways you can buy Corus – either on the Toronto exchange under the ticker CJR.B or on the U.S. OTC market under the ticker CJREF. The Toronto shares’ trade volume was over 1.65M shares on 10/18/17, and the U.S. OTC shares traded around 58,000 shares.

Since OTC share prices can jump around a lot, your best bet is to get your online broker to figure out if the US OTC ask price relates properly to the Toronto price. There also may be about a $ .01/share upcharge between the shares. If there isn’t enough US volume to fill an order, some brokers, such as Schwab, fill it on the Toronto exchange. Schwab has an interesting feature on its site, which allows you to input the CJREF ticker and see the price on the Toronto exchange.

Dividends:

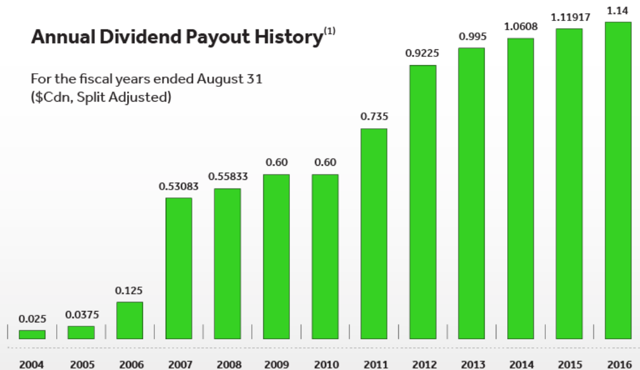

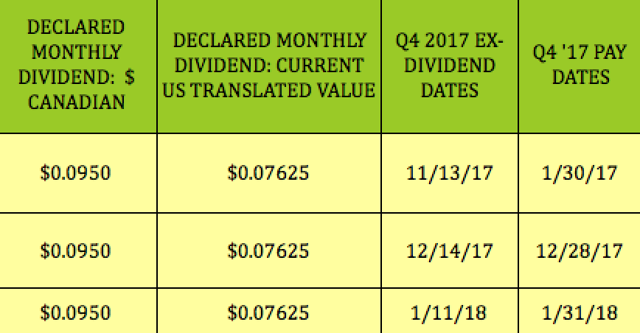

CJREF yields 9.18% currently and will go ex-dividend next on 11/13/17. This isn’t a big dividend growth stock – the five-year growth rate was 4.72%, and management intends to maintain its current $ .095 monthly dividend in fiscal 2018, as it focuses on further deleveraging. But, hey, a well-covered 9%-plus yield on a monthly payout is nothing to sneeze at, is it?

Our High Dividend Stocks By Sector Tables track CJREF’s price and current dividend yield (in the Services section).

Corus’s dividends are treated as qualified dividends for US investors – they should be listed as such on your broker’s consolidated year-end 1099. There’s a 15% Canadian tax paid on the dividends, which you can reclaim on your taxes, except on non-tax-reporting accounts.

Corus’s dividends are treated as qualified dividends for US investors – they should be listed as such on your broker’s consolidated year-end 1099. There’s a 15% Canadian tax paid on the dividends, which you can reclaim on your taxes, except on non-tax-reporting accounts.

Management has declared dividends, dates of record, and pay dates for all three months of Q4 2017:

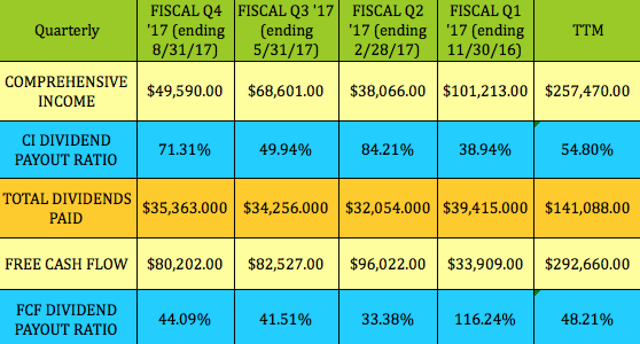

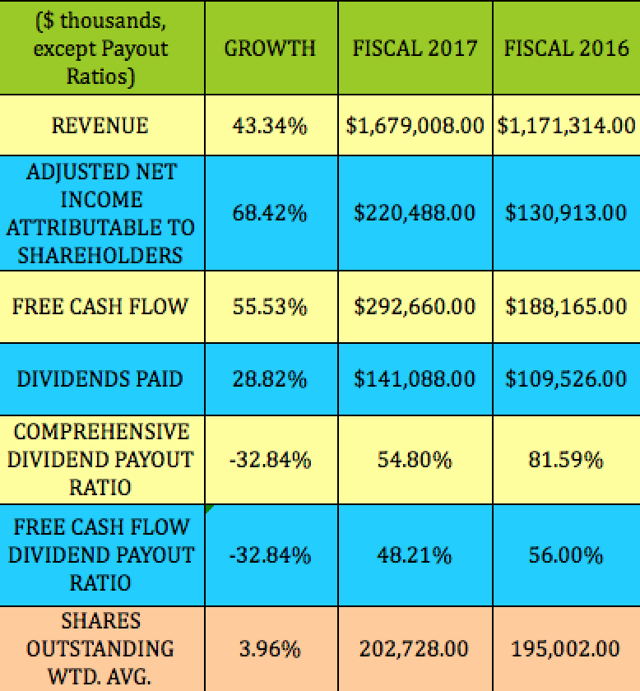

We analyzed Corus’s dividend payout ratio from two angles – Comprehensive Income, which shows a trailing ratio of 54.80%. On a free cash flow basis, the payout ratio looks less lumpy over the past three quarters, and is an average of 48.21% for fiscal 2017, which ended on 8/31/17.

We analyzed Corus’s dividend payout ratio from two angles – Comprehensive Income, which shows a trailing ratio of 54.80%. On a free cash flow basis, the payout ratio looks less lumpy over the past three quarters, and is an average of 48.21% for fiscal 2017, which ended on 8/31/17.

Corus’s payout remained at $ 1.14 in fiscal 2017 and will most likely remain there for fiscal 2018, as maintaining the dividend is one of management’s stated priorities for next fiscal year.

Corus’s payout remained at $ 1.14 in fiscal 2017 and will most likely remain there for fiscal 2018, as maintaining the dividend is one of management’s stated priorities for next fiscal year.

Options:

There are no U.S. options listed for CJREF, but you can see details for over 25 other income-producing trades in both our Covered Calls Table and our Cash Secured Puts Table.

Earnings:

Corus just reported its fiscal Q4 and full year 2017 earnings, 10/18/17.

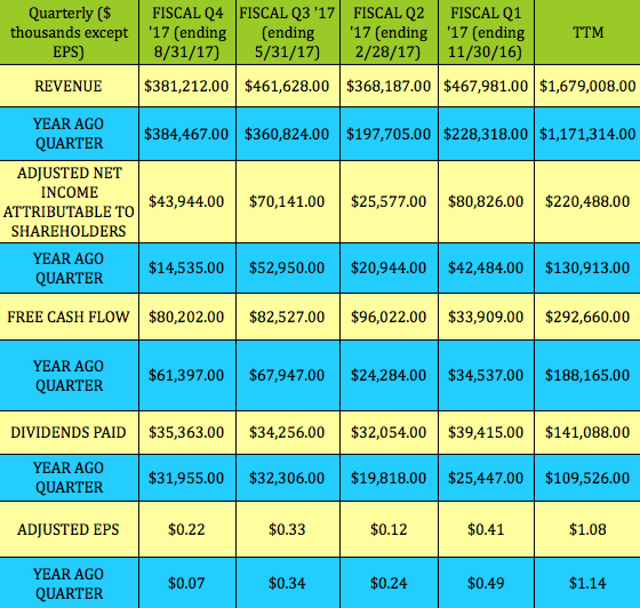

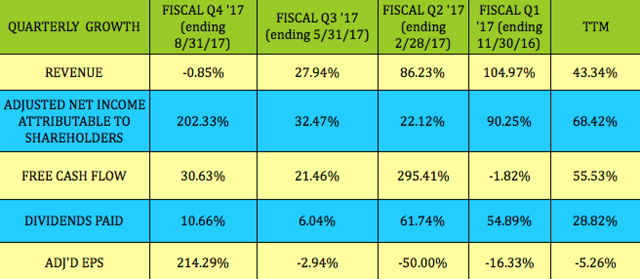

Although revenue was flat in Q4, all of the other categories jumped, with adjusted net income up 202%, adjusted EPS up 214%, and free cash flow up over 30%.

Management met its three key objectives for fiscal 2017: 1) completing the integration of Shaw Media and capturing annualized cost synergies which were greater than the original target of $ 40-50 million, 2) improving the company’s competitive position in the marketplace, and 3) significantly increasing free cash flow and achieving Corus’s target to delever to below 3.5 times net debt to segment profit by the end of fiscal 2017. (Source: Corus site)

One of the reasons for the quarterly lumpiness in dollar figures is that management not only had to integrate the Shaw acquisitions, which made it a much larger company, but, in addition, as part of the deal, Corus sold off its pay-TV operations, which no longer contributed to earnings.

One of the reasons for the quarterly lumpiness in dollar figures is that management not only had to integrate the Shaw acquisitions, which made it a much larger company, but, in addition, as part of the deal, Corus sold off its pay-TV operations, which no longer contributed to earnings.

Revenue jumped 43%, adjusted net income rose 68%, and free cash flow rose 56% in fiscal 2017.

Further evidence of the company’s successful transformation in 2017 – even though total dividends paid jumped 29%, Corus’s dividend payout ratios improved dramatically, on both a comprehensive income and a free cash flow basis:

New Developments:

New Developments:

“On October 17, 2017, the company announced it had reached an agreement to sell its French-language specialty channels Historia and Séries+ to Bell Media. The total value of the transaction is approximately $ 200 million CDN and is subject to customary price adjustments upon closing. The sale is pending approval by the CRTC and the Competition Bureau, and is expected to close in 2018. As management mentioned on the earnings call, this sale of non-core assets will be key in helping Corus reduce its leverage down to 3x in fiscal 2018.” (Source: Corus Q4 ’17 earnings release)

“On October 17, 2017, the company’s Nelvana subsidiary and Discovery Communications announced the formation of a new venture to produce a new pipeline of content to the kids’ market in Canada, Latin America and around the world. Based in Canada, the yet-to-be named venture operates independently of Corus, Discovery and Nelvana’s other services, and is dedicated to the production of premium children’s content across linear and digital platforms. The venture combines the strength of the hugely successful Discovery Kids business in Latin America, and Corus’ high-ranking suite of kids’ channels in Canada – both of whom will commission content from the new production company.” (Source: Corus Q4 ’17 earnings release)

Management is very focused on increasing Corus’s content creation output – in fiscal 2017, the company more than doubled the Corus Studios slate and export of content to foreign markets. This deal should help to continue that momentum and has the potential to deliver organic earnings growth to Corus over the coming years.

In fiscal 2017, management created a Data Analytics and Ad Tech team and plans to double its investment in ad tech in 2018. It also created a video on demand dynamic ad insertion program, which will allow it to monetize content on the video platform. So far in Q1 of fiscal ’18, Corus is seeing strong demand from advertisers for video on demand ad services, with 20 companies signing up so far. It increased the company’s audience segmentation capabilities, which leverages its data and allows it to offer more targeted ad campaigns, which have attracted new advertisers.

“On September 28, 2017, Federal Minister of Canadian Heritage, Melanie Joly, unveiled the results of her consultations on the Canadian culture sector. The Minister’s policy vision entitled “Creative Canada” confirms reviews of the Broadcast Act and Telecommunications Act will proceed, beginning with a report by the CRTC on the state of the broadcasting sector. That report must be completed by June 1, 2018, and will become the factual foundation for the Government to consider making changes to the Broadcasting Act.” (Source: Corus site)

“Overall, it looks like the federal government is hoping to create a system in which creators can thrive in Canada before finding international audiences. However, some Canadian companies wanted new regulations on foreign-based companies that don’t pay taxes in Canada. However, the new system should please creators and artists who will now replace content distributors as the key focus of federal cultural programs. In particular, Ms. Joly wants to increase funding in the early stages of the development of television and movie scripts, for example, to encourage risk-taking by Canadian writers.” (Source: Globe & Mail)

Risks:

Currency exchange – As with most foreign shares, you’ll gain diversification vs. your U.S.-based holdings. The flip side of this is that you’ll have currency risk exposure. However, the Canadian dollar has gained over 4% vs. the US dollar since our last article about CJREF in late June and has gained nearly 8% so far in 2017.

The B shares are non-voting shares, which give shareholders no access to voting rights on company issues. So, it comes down to trusting management, which has performed well so far.

OTC buying – As we mentioned earlier, since OTC share prices can jump around a lot, your best bet is to get your online broker to figure out if the US OTC ask price relates properly to the Toronto price.

Analysts’ Targets and Performance:

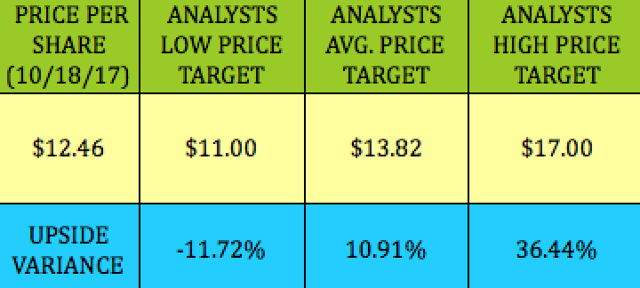

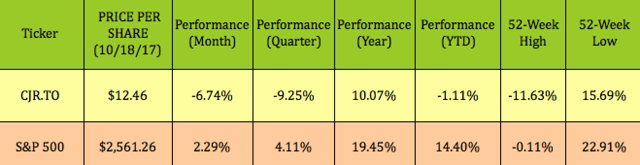

The market doesn’t seem to be showing Corus much support in the past quarter – it topped out ~$ 14.00 in early August and has fallen 9.25% since.

Corus is currently around 10.91% below the consensus price target of $ 13.82:

Corus is currently around 10.91% below the consensus price target of $ 13.82:

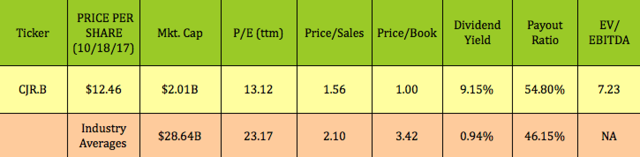

Corus has a standout high dividend yield of over 9%, in a stingy industry – the next closest yields we could find were Shaw at ~4% and Viacom (VIAB) at ~3%. Disney (DIS) only yields 1.59%, which is lower than the venerable World Wresting Entertainment (WWE), which weighs in at a puny 2.13%. All that spandex must be expensive.

Corus is currently selling at right around book value – it looks cheaper than broad industry averages on a P/book, P/E, and a price/sales basis.

Financials:

Financials:

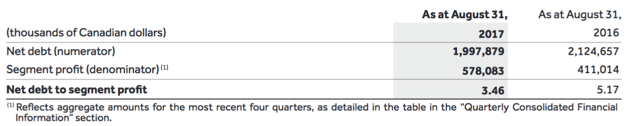

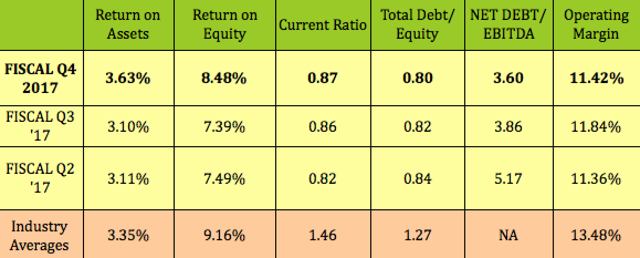

Take a look at the improvement in net debt/EBITDA in fiscal 2017, from 5.17x down to 3.6x in the past two quarters – that’s a big, impressive 30% drop in leverage.

These industry averages are a bit of a hodge-podge – this industry’s assets match up about as well as your average college student’s dorm room decor. However, it does look like Corus’s ratios are in the ballpark – although the operating margin could use some improvement.

Debt:

Debt:

Management successfully attained its goal of deleveraging in fiscal 2017 – it brought its net debt/segment profit ratio down all the way from 5.17x to 3.46x as of 8/31/17. In fiscal 2018, management is continuing this focus on deleveraging and is targeting a 3.0 leverage ratio. When asked about future acquisitions for 2018 on the earnings call, it replied that it sees its industry’s assets as overpriced currently, and it has no intention of chasing them in this strong market:

Summary: We continue to rate Corus a long-term buy, based upon its attractive dividend yield, monthly payouts, and the strength of its management, which has successfully brought the company through a major transformation, delivering on its promises in fiscal 2017.

All tables furnished by DoubleDividendStocks.com, unless otherwise noted.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

Disclosure: I am/we are long CJREF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Tech