Investment Thesis

How about we start with this line from John Flannery, Chairman and CEO of General Electric (GE):

“This was a very challenging quarter.”

Or as I would translate this to my 12-year-old:

“I have another pile of excuses to share with you.”

In February, I told you that GE would fail you if you keep it in your portfolio. Many of you didn’t listen and told me that they were happy to keep shares they bought around $ 9 while they were in their $ 30s at the time of my first article. Now fast forward today, the stock keeps going lower and lower and now trades around $ 23 after GE missed expectations (again) with their Q3 2017.

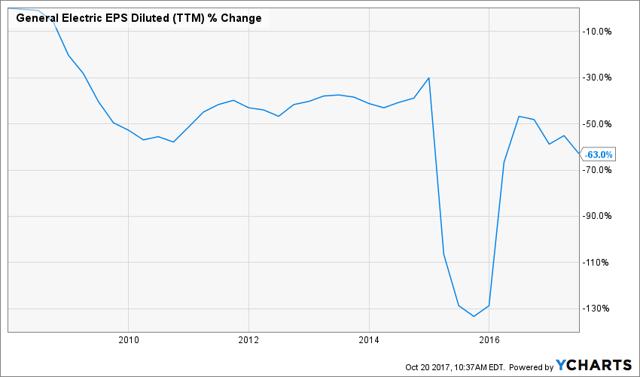

Source: Ycharts

GE stock is seriously underperforming the market. Imagine if we were in a bear market. The company struggles to structure its business and find growth vectors. Many divisions show sales slowdown, notably its oil segment which will continue to hurt in the coming years.

The company is in cost control mode with expectations to cut $ 2 billion in expenses. You will discover in this analysis that while management must cut the fat, there might not be room for dividends in the future anymore. Are you ready to swallow another dividend cut?

Understanding the Business

General Electric is a 100-year-old company offering various digital industrial products. Over the past few years, the company has realigned all its business segments toward powering the industrial internet with its software experience. GE has purchased Baker Hughes and Alstom in the past couple of years in hopes of generating growth. Unfortunately, management keeps telling investors to remain patient. Can you afford to continue to be patient?

The company counts eight divisions among its “GE Store”” Power – combustion science and services, installed base; Energy connections -electrification, controls and power conversion technology; Renewable energy – sustainable power systems and storage; Oil and Gas – services and technology; Transportation – engine technology and localization in growth regions; Lighting – LED bulbs; Healthcare – diagnostics technology; Aviation – advanced materials, manufacturing and engineering products.

Earnings

Source: Ycharts

The company got rid of GE capital which was responsible for most of its problems back in 2008 (where they implemented a dividend cut). As financials are rising, GE counts on a slow growing industrial division to replace GE capital’s once profitable business.

As Trian (a multi-billion dollar asset management company) is taking more control of GE’s board, you can expect additional cuts in costs and short cuts to short-term profits. As Nelson Peltz (Trian founder) is bullying his way through Procter & Gamble (PG) to do the same, another founder Edward Garden is doing it at GE. I prefer to stay away from this kind of battle as a dividend growth investor.

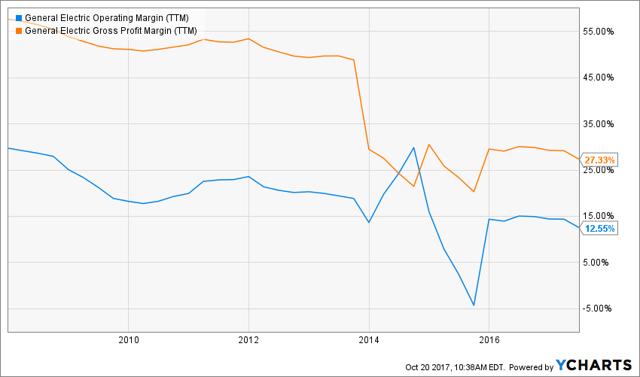

Source: Ycharts

When you look at GE’s margins, I can’t blame Trian to raise the flag and ask for action before it’s too late. But as management cuts their budget and tries to align their company on the right track, I fear these actions will put the dividend in jeopardy… again.

Dividend Growth Perspective

Source: Ycharts

The dividend was cut eight years ago, and the company has not yet returned to those payout levels. The dividend growth looks interesting over the past five years. After all, this iconic company managed to increase its dividend by a 4.78% annualized growth rate over this period of great modifications. Even better, the latest stock price plunge opens the door to income seekers with a juicy dividend yield over 4%.

Well, my friend, think again…

The company’s current payout ratio seems out of control with a 112% ratio. However, it gets worse when we use the cash payout ratio. We can see the company is bleeding cash at the moment. Remember, the payout ratio is a good indicator of a company’s ability to sustain its dividend, but it remains based on accounting numbers, not real cash. I don’t see how the company will continue to raise its dividends in such a situation.

Potential Downsides

As you can tell by now, I’m quite bearish on GE. I think that if the oil industry doesn’t shift toward a bullish mood any time soon, GE will have no other choice but to stop increasing its dividend. Eventually, this could lead to a dividend cut. Look again at the payout ratio, this situation is unsustainable.

What used to be a great investment after GE cut a deal with Buffett isn’t that great anymore. At best, GE will hover in the $ 20s for a decade, leaving you behind the market and other great dividend growth stocks such as Honeywell (HON).

Valuation

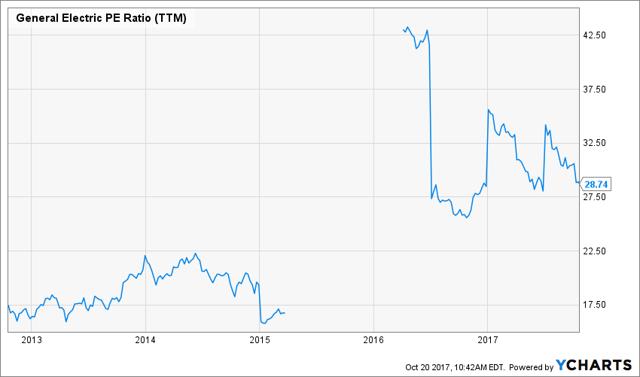

You may think that after a nearly 30% drop this year, GE stock would be on sale. You will be surprised to realize it is still trading at a 28 PE ratio. This is a very high PE for a company that is not growing.

Source: Ycharts

Please note the forward PE ratio is now at 15, leaving hope for the most optimistic investors. However, when I use the dividend discount model to determine a fair value, I can only see that GE doesn’t pay me enough, even with a 4% yield.

|

Input Descriptions for 15-Cell Matrix |

INPUTS |

||

|

Enter Recent Annual Dividend Payment: |

$ 0.96 |

||

|

Enter Expected Dividend Growth Rate Years 1-10: |

3.00% |

||

|

Enter Expected Terminal Dividend Growth Rate: |

5.00% |

||

|

Enter Discount Rate: |

10.00% |

||

|

Discount Rate (Horizontal) |

|||

|

Margin of Safety |

9.00% |

10.00% |

11.00% |

|

20% Premium |

$ 25.72 |

$ 20.70 |

$ 17.35 |

|

10% Premium |

$ 23.57 |

$ 18.98 |

$ 15.91 |

|

Intrinsic Value |

$ 21.43 |

$ 17.25 |

$ 14.46 |

|

10% Discount |

$ 19.29 |

$ 15.53 |

$ 13.02 |

|

20% Discount |

$ 17.14 |

$ 13.80 |

$ 11.57 |

Please read the Dividend Discount Model limitations to fully understand my calculations.

As you can see, GE stock is nowhere near its “fair dividend value.” I’m not saying GE will drop to $ 17 within the next 12 months. But I’m saying that GE will not pay you enough to compensate for the risk you are taking. Let it go.

Final Thought

While you are happy with your paper profit, keep in mind that this virtual money is shrinking fast while the market keeps going up. You are missing out on an opportunity cost here. Maybe it’s time to cash in your profit and look at other opportunities.

Disclaimer: I do not hold GE in my DividendStocksRock portfolios.

I’m long HON.

If you like my analysis, click on FOLLOW at the top of the article near my name. That will allow my articles to display on your homepage as they are published.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Disclosure: I am/we are long HON.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Tech