I think most investors and analysts are bearish when it comes to Tanger Factory Outlet Centers (SKT). Seeking Alpha happens to have a group of analysts who don’t share this majority view. I wrote an article on the dividend champion selling at an insane discount. I’ve been asked numerous questions since the article, so let me answer some of them for you. But before we start, check out SKT trading at more… of a discount:

I love a discount. I added to my position this morning.

The market is stricken with fear. Zombies have taken over mall REITs. Mall REITs are no longer inhabitable and will soon cease to exist. I may have embellished on why the market is stricken with fear. However, the market is pricing mall REITs at insanely low prices. My main coverage is on mortgage REITs and equity REITs. When it comes to mortgage REITs, the sector is overpriced (started to come down after Q3 2017 earnings releases). When it comes to equity REITs, there are enormous discounts for mall/shopping REITs. Let that sink in for a moment. While you’re thinking, recall this quote:

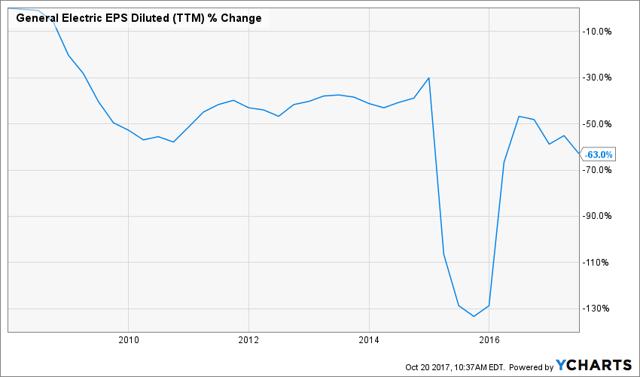

Instead of using this logic, we are seeing something else entirely. Analysts are noticing some equity REITs surrounded by fear and then looking for information to defend their“analysis”. Which in turn, perpetuates the fear that mall REITs are going to somehow cease existing.

Why the recent price drop

The “Amazon (AMZN) effect” is weighing on mall REITs. Amazon smashed estimates. Amazon beat on earnings and thoroughly beat on revenues. The growth was heavily influenced by Amazon Web Services and Whole Foods Market. That’s ironic. Amazon saw a strong quarter by owning physical retail stores.

Another factor was J.C. Penney (JCP) slashing their outlook. The company adjusted guidance for the year. For the year, guidance for EPS is now $ 0.02 to $ 0.08 instead of $ 0.40 to $ 0.65. After the news, JCP went down 21%.

These two factors led the market to drop prices on mall REITs. Perhaps, the big question is what are REITs to do about JCP going down? The answer is simple: replace them.

SKT is already done with that job. They finished it early by simply not having any JCP stores. From the Q2 earnings call:

“Teavana is the latest to announce closing and we have no Teavana locations in our Tanger portfolio. We also have no Sears, K-Mart, JC Penney, hhgregg, or GameStop stores.”

Why SKT is a buy today

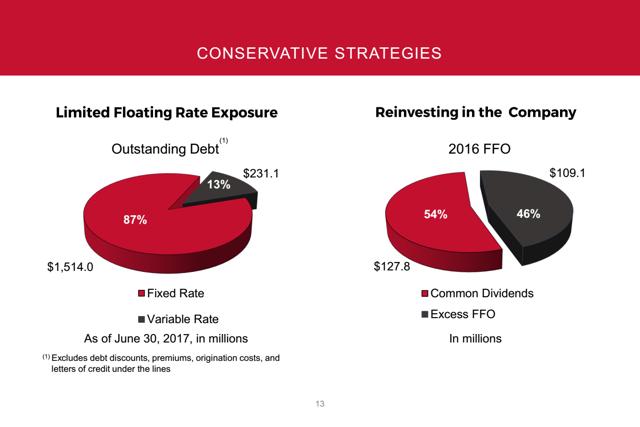

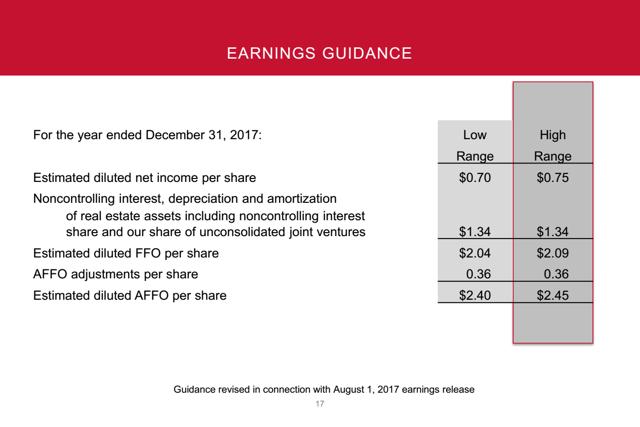

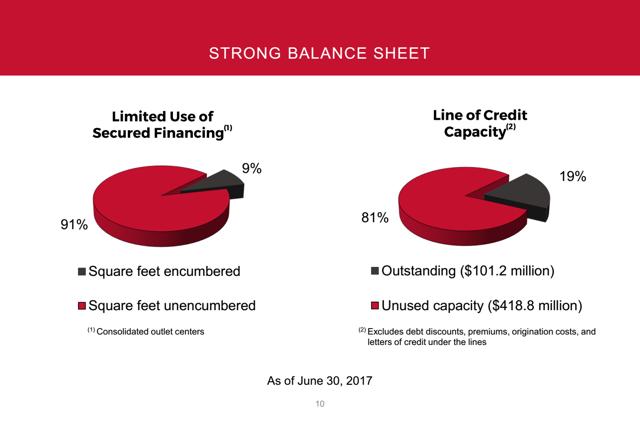

SKT is trading at a mere 9.5x AFFO guidance for the year. SKT maintains a conservative balance sheet which prevents them from having any difficulty with their debts.

The dividend yield is nearly 6% and is easily covered by AFFO. The excess AFFO is available for reinvesting into the portfolio or repurchasing shares.

The dividend yield is nearly 6% and is easily covered by AFFO. The excess AFFO is available for reinvesting into the portfolio or repurchasing shares.

In the second quarter, management was actively buying back stock because it is immediately accretive to AFFO per share. SKT has a couple new properties opening up which should increase net operating income and AFFO per share.

Following those openings, SKT has relatively few capital expenditures coming up over the next couple of years. This makes it easier for them to grow the dividend and gives them the option of repurchasing stock faster than most REITs.

Following those openings, SKT has relatively few capital expenditures coming up over the next couple of years. This makes it easier for them to grow the dividend and gives them the option of repurchasing stock faster than most REITs.

Serious problem

SKT offers both FFO and AFFO for investors. It’s even in their presentations:

One issue is that websites offer inaccurate information. For analysts who are trying to figure out mortgage REITs and equity REITs, this can be a serious problem.

I’ve taken a look at the sites which give out FFO and AFFO numbers in the REIT sector. They are often inaccurate. The test is rather simple. Investors should check the websites calculations to verify that they are accurate. When you do this test and find the numbers don’t match, dig deeper. Check the numbers against the press releases for Realty Income (O), National Retail Properties (NNN), and a few other large REITs. If you find frequent contradictions, that’s a problem. Make sure to insert mall REITs, such as Macerich (MAC), as well since they have more complicated statements due to the impact of JVs.

JVs (joint ventures)

In my view, GAAP creates the problem by not forcing standardized reporting of JV interests on a pro-rata basis.

Joint ventures can obfuscate what’s really going on. For instance, NNN is top notch for transparency and accounting quality. It starts to get mixed up when the company has major positions in JVs. Proportional consolidation would fix the problem, but we usually get “one line consolidation” which makes the statements ugly. Assuming the company owns positions in unconsolidated JVs, the depreciation related to those positions does not show up directly in any of the financial statements. To find it, you would need to look for a reconciliation on FFO or NOI. Quite simply, it wouldn’t be possible to correctly automate FFO in these situations unless the tool could pull data that is not in the income statement, balance sheet, cash flows, or changes in shareholder’s equity.

This is one of the reasons I find JV accounting so annoying. I really wanted a tool that would work, but without a standardized method that requires all JVs to be reported the same way, it can’t happen. When we go to AFFO, it is critical for an analyst to use judgment on which adjustments are reasonable. I agree with most of the major REITs, but a few of the smaller ones created silly adjusted metrics that were just useless.

Suggestion

When looking through a third party’s statements on a company, I suggest checking the actual company’s press release for each quarter.

I think SKT is still at attractive prices and the same goes for Simon Property Group (SPG). I would be interested in buying some MAC, but the price came back up materially over the last few weeks. I would prefer to align my portfolio more defensively given the high valuation on domestic equity markets. Credit spreads on rated bonds are also absurdly thin. The entire situation encourages me to be more defensive. However, I see quite a few Mall REITs trading around 30% to 70% of their net asset value per share. Some of those REITs are running high quality properties. I wouldn’t mind being part of a group purchasing the physical real estate. The stock price will fluctuate much more, but I get great liquidity and a huge discount on buying in.

Reconciliations and adjustments can be confusing

I’ve become accustomed to spinning through reconciliations and knowing what adjustments to keep or throw out. It took a while and a significant amount of time spent looking through both good and bad REITs to reach a conclusion. In my opinion, if you want to see an example of where lots of adjustments are garbage, look at Wheeler (WHLR). If you go back in time to Q2 2016, the Resource Capital Corporation (RSO) adjustments under old management were hilarious since it was an mREIT trying to use equity REIT adjustments. RSO’s adjustments under new management are reasonable.

O and NNN are always great. SPG is very high quality for a mall REIT while attempting to tackle the JV issue, but they have JVs and own a huge stake in a European mall REIT.

Final thoughts

Mall REITs have become out of favor. The current prices aren’t built around fundamentals or guidance. The prices are built around fear of malls dying. They will not die. The space the malls currently own definitely will not die. Whatever the better malls transition into will continue to use the space they own. I’m going to stake my money against the market’s fear by owning several mall REITs. I started buying in earlier this summer and will be adding more as I find great values. Often it is great values on great companies.

I do believe the sector is largely undervalued. However, I would not invest using an index. I have enough capital to diversify and can research each stock separately to ensure I am buying exactly what I want at the price I want to pay. Using an index works for investors who want the extra diversification, but for the ideal entry price, I would much rather pick individually.

If prices keep going down, I have the capital and stomach to buy more. Remember, when others are fearful… perhaps it is time to be greedy.

Click The REIT Forum to sign up for:

- Actionable buy and sell target prices

- Best research on preferred shares and REITs

- Best reviews on the site – 294/295 stars

- Stable dividend yields over 7%

- You get instant actionable SMS alerts

- Sign up before November 1st, 2017 to lock in at $ 370/year

Disclosure: I am/we are long SPG, SKT.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: No financial advice. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints. CWMF actively trades in preferred shares and may buy or sell anything in the sector without prior notice. Tipranks: Buy SKT.

Editor’s Note: This article covers one or more stocks trading at less than $ 1 per share and/or with less than a $ 100 million market cap. Please be aware of the risks associated with these stocks.

Tech